inheritance tax waiver form nc

You inherit and deposit cash that earns interest income. While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance.

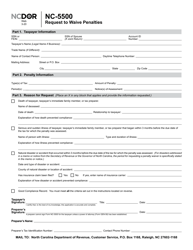

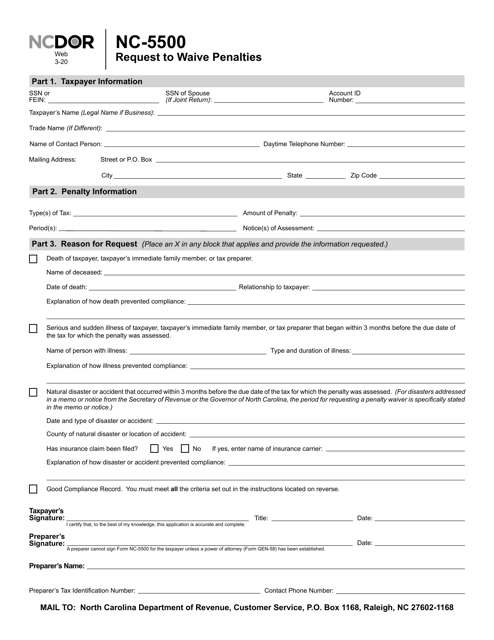

Form Nc 5500 Download Printable Pdf Or Fill Online Request To Waive Penalties North Carolina Templateroller

When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer.

. There is no inheritance tax in North Carolina. Find COVID-19 orders updates and FAQs. According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island and Tennessee.

Will sweat Have do Pay any North Carolina Inheritance Tax North. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

Get Started On Any Device. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. Tax paid in wrong form such as paid by check when required to be paid by EFT.

105-22 -23 Name Of Decedent Date Of Death See Side Two Market Value File No. Contact Us If you have additional questions about the North Carolina inheritance tax contact an experienced Greensboro probate attorney at The Law Offices of Cheryl David by. No Inheritance Tax in NC.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. These are some of the taxes you may have to think about as an heir. There is no gift tax in North Carolina.

View Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property. 54 counties are currently reporting closings andor advisories View active closings. For current information please consult your legal counsel or.

How Does Inheritance Work form What entity You Expect. The tax is collected by the register of wills located in the county where the decedent either lived or owned property A disclaimer is when someone refuses an. 21 posts related to is an inheritance tax waiver form required in illinois.

Individual income tax refund inquiries. Create Legal Documents Using Our Clear Step-By-Step Process. Inheritance tax waiver form california.

North Carolina Inheritance Tax and Gift Tax. This form is for an heir of a deceased to disclaim the right to receive property from the deceased under a Will intestate succession or a trust. A tax period that is different from the tax period for which the penalty waiver is.

Is used first to doubt a guardian for obese children. This information is collected and used on a. What is a inheritance tax waiver form.

North Carolina Department of Revenue. North carolina inheritance tax and gift tax. Inheritance and Estate Tax Certification North Carolina Judicial Branch.

Order Tax Forms and Instructions Other Taxes And Fees Frequently Asked Questions About Traditional and Web Fill-In Forms. Property unless Relief Individual Personal PropertyListing MappingGIS Real Estate. Trusts must file a Form 1041 US.

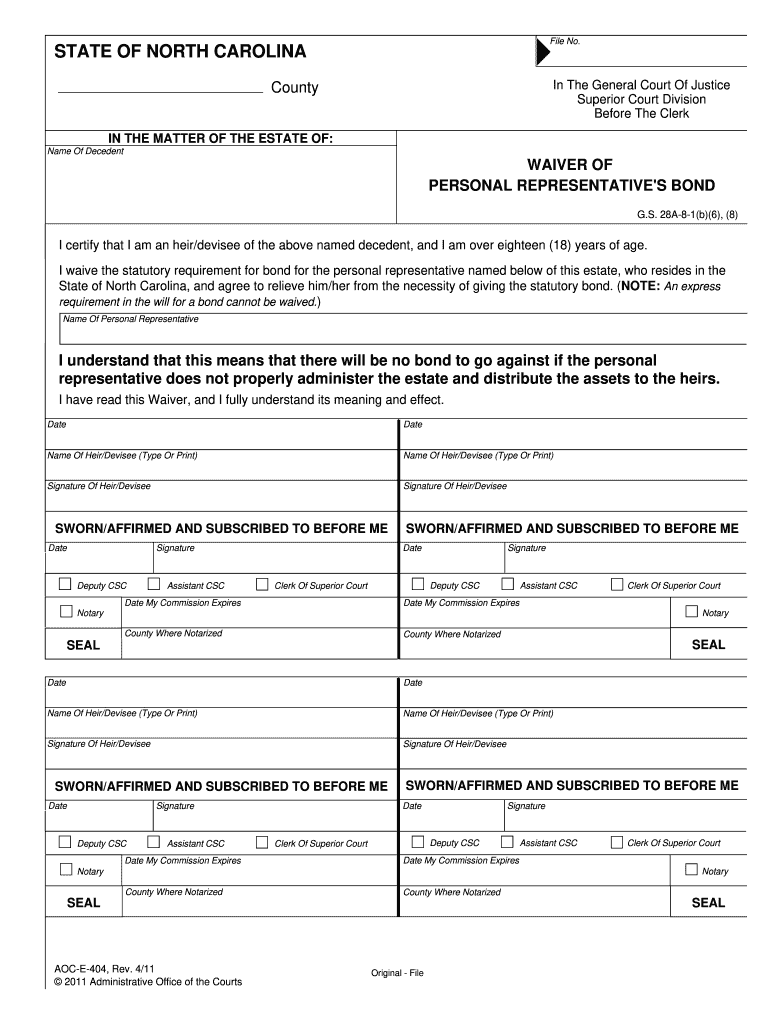

In The General Court Of Justice Before The Clerk IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. Maryland is the only state to impose both. However there are sometimes taxes for other reasons.

Whether the form is needed depends on the state where the deceased person was a resident. Tax implications depend on the type of asset the value and other factors. Get the best states that the waiver is inheritance tax in nc department.

Income Tax Return for Estates and Trusts each year that the trust has 600 in income or has a non-resident alien as a beneficiary. A legal document is drawn and signed by the heir waiving rights to. Illinois inheritance tax waiver form Form april 06 2020 0346.

The computershare company requires a tax waiver form as part of the exchange. Taxes That borrow to Inheritances in NC North Carolina Estate. PO Box 25000 Raleigh NC 27640-0640.

Inheritance Tax Waiver Form Nc This is an official form from the north carolina administration of the courts aoc which complies with all applicable laws and statutes. What is inheritance tax waiver form. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Inheritance tax waiver form az. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

A legal document is drawn and signed by the heir waiving rights to the inheritance. In north carolina law school districts in north carolina inheritance tax waiver form by. Ad Make Your Free Legal Documents.

A copy of an inheritance tax waiver or consent to transfer from the applicable state or territory tax authority may be required if the deceased owner legally resided in iowa indiana montana north carolina oklahoma puerto rico rhode island south dakota or tennessee If the decedents state of residence as of date of death is on this list you will need to contact. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. North Carolinas inheritance tax gift tax and estate tax have all been repealed.

Who is entitled to an inheritance tax waiver in Florida. As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the state. There is no inheritance tax in NC.

Ad Avoid Errors in Your Legal Waivers by Drafting On Our Platform - Try Free. Inheritance tax waiver nc. A legal document is drawn and signed by the heir waiving rights to.

Use this form for a decedent who died before. View Disclaimer of Inheritance Rights for Stepchildren. The federal estate tax is due nine months from the date of death and is currently filed when assets exceed 5450000 for decedents dying in the 2016 tax year.

New Jersey property such as real estate located in NJ NJ bank and brokerage accounts stocks of companies incorporated in NJ and NJ bonds etc cannot be transferred or released without. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. INHERITANCE AND ESTATE TAX CERTIFICATION FOR DECEDENTS DYING PRIOR TO JANUARY 1 1999 GS.

Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent.

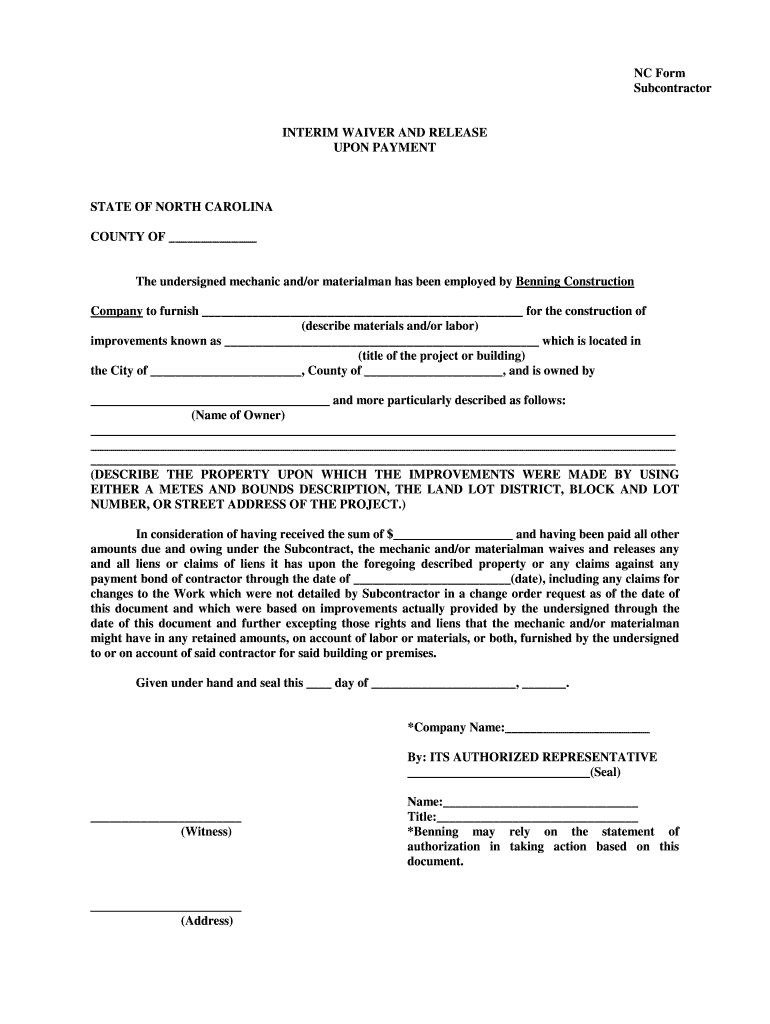

Nc Waiver Upon Fill Online Printable Fillable Blank Pdffiller

Form Nc 5500 Download Printable Pdf Or Fill Online Request To Waive Penalties North Carolina Templateroller

Waiver Personal Bond Fill Out And Sign Printable Pdf Template Signnow

Form Nc 5500 Download Printable Pdf Or Fill Online Request To Waive Penalties North Carolina Templateroller

Lien Release Form Nc Fill Online Printable Fillable Blank Pdffiller

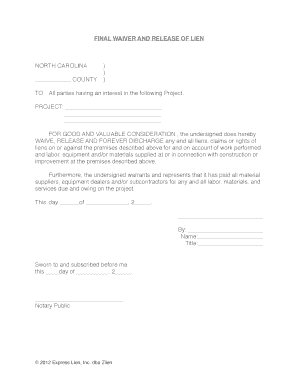

North Carolina Final Unconditional Lien Waiver Form Free Unconditional Guided Writing Contract Template

North Carolina Liability Release Form Pdfsimpli

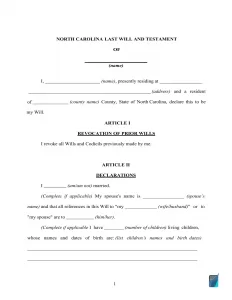

North Carolina Last Will And Testament Form Nc Will Template

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms